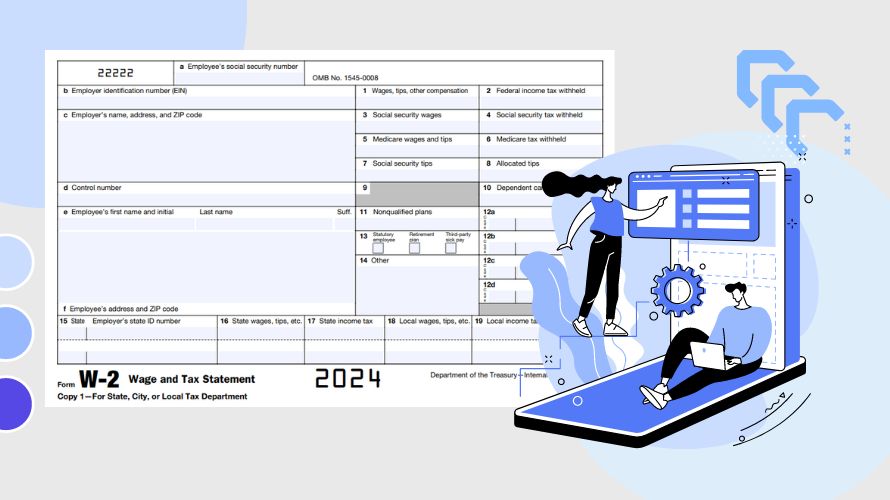

Printable IRS Form W2 for 2024

- 19 January 2024

Tax season can be stressful, but it's also an opportunity to get things right for a smoother financial journey. A critical component in this process is the W-2 form, the primary earnings statement for anyone who works as an employee. If you're tackling your taxes on your own, understanding how to obtain and correctly fill out your W-2 is essential.

Accessing the W-2 Tax Form for 2024

Before we delve into the specifics, let's address how you can get your hands on a copy. I'm thrilled to share that you can access a printable blank W2 form right here on our website at no cost. This means no more frantic searches or stress over obtaining the right form. With a printer and a few minutes of your time, you can have your template ready to go.

Ensuring that you have the form accessible means you're already taking a big step towards accuracy and compliance with your tax reporting. Remember, while electronic filing is commonly promoted, having a printed copy to manually fill out is still perfectly viable and sometimes preferred for record-keeping.

Understanding the Printable IRS Form W2

The Form W2 is not just a piece of paper; it's an official document that provides the IRS with vital information about your income, taxes withheld, and other pertinent wage-related data. Your employer is tasked with completing most of this form, but if you're using a W-2 printable form for your records or adjustments, you need to know the essentials.

There are several important fields on the W2 form for 2024, including those for your Social Security Number (SSN), employer identification number (EIN), wages earned, and federal/state tax withheld. Be meticulous when reviewing these numbers. Transcribing them incorrectly can lead to processing delays or, worse, you might owe additional taxes.

Filling Out Your Printable W2 Form

As you undertake the task of recording the necessary information on your printable W2 form for free, double-check all entries for accuracy. The smallest typo or misplaced digit can result in significant discrepancies. Verify your personal information and compare all the financial data with your last pay stub of the year. This is a common mistake that can be easily avoided.

Another tip as you navigate through this process is to be aware of the various boxes and what they represent. For instance, Box 1 reports your total taxable wages, tips, prizes, and other compensation, while Box 2 shows the total tax withheld from your earnings for the year. The more familiar you become with these sections, the more confident you'll be when filling out the form.

Avoiding Common Mistakes with Your Printable W2 Form

To prevent errors on this crucial document, verify that all employer-provided information matches your records.

- If you're using our printable IRS Form W2, it's a good idea to have previous years' forms on hand to ensure consistency.

- Don't forget to sign and date the form if you're submitting a paper return; an unsigned form can lead to unnecessary delays.

- Remember that your W-2 form is a foundational piece of your tax puzzle. Approach it with care and attention, and you'll navigate tax season like a pro.

Utilize our free printable W2 form for 2023 to take control of your finances now; this practical, hands-on approach may help you gain better insight into your tax situation and even uncover opportunities for savings.